Property Information

| Serial Number: 51:542:0002 |

Serial Life: 2015... |

|

|

Total Photos: 20

|

| |

|

|

| Property Address: 2190 W 250 SOUTH - PLEASANT GROVE |

|

| Mailing Address: 978 WOODOAK LN SALT LAKE CITY, UT 84150 |

|

| Acreage: 3.164374 |

|

| Last Document:

89504-2014

|

|

| Subdivision Map Filing |

|

| Legal Description:

PARCEL B, PLAT A, RESIDENCES AT MAYFIELD SUB AREA 3.164 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

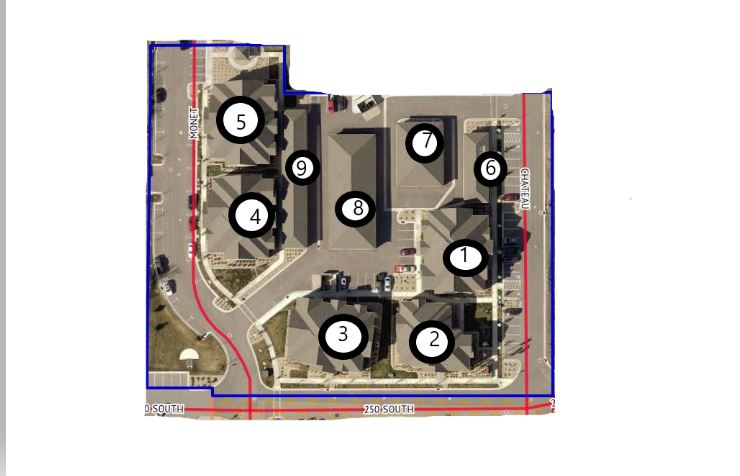

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2025 |

$0 |

$1,785,700 |

$0 |

$1,785,700 |

$0 |

$6,814,100 |

$0 |

$6,814,100 |

$0 |

$0 |

$0 |

$8,599,800 |

| 2024 |

$0 |

$1,150,700 |

$0 |

$1,150,700 |

$0 |

$5,242,100 |

$0 |

$5,242,100 |

$0 |

$0 |

$0 |

$6,392,800 |

| 2023 |

$0 |

$1,139,300 |

$0 |

$1,139,300 |

$0 |

$5,190,200 |

$0 |

$5,190,200 |

$0 |

$0 |

$0 |

$6,329,500 |

| 2022 |

$0 |

$1,275,900 |

$0 |

$1,275,900 |

$0 |

$4,557,716 |

$0 |

$4,557,716 |

$0 |

$0 |

$0 |

$5,833,616 |

| 2021 |

$0 |

$1,215,100 |

$0 |

$1,215,100 |

$0 |

$5,535,700 |

$0 |

$5,535,700 |

$0 |

$0 |

$0 |

$6,750,800 |

| 2020 |

$0 |

$1,157,300 |

$0 |

$1,157,300 |

$0 |

$5,272,100 |

$0 |

$5,272,100 |

$0 |

$0 |

$0 |

$6,429,400 |

| 2019 |

$0 |

$1,190,600 |

$0 |

$1,190,600 |

$0 |

$4,762,500 |

$0 |

$4,762,500 |

$0 |

$0 |

$0 |

$5,953,100 |

| 2018 |

$0 |

$931,800 |

$0 |

$931,800 |

$0 |

$4,244,900 |

$0 |

$4,244,900 |

$0 |

$0 |

$0 |

$5,176,700 |

| 2017 |

$0 |

$1,035,400 |

$0 |

$1,035,400 |

$0 |

$4,141,700 |

$0 |

$4,141,700 |

$0 |

$0 |

$0 |

$5,177,100 |

| 2016 |

$0 |

$1,035,400 |

$0 |

$1,035,400 |

$0 |

$4,141,700 |

$0 |

$4,141,700 |

$0 |

$0 |

$0 |

$5,177,100 |

| 2015 |

$660,300 |

$0 |

$0 |

$660,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$660,300 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax Area |

| 2026 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2025 |

$39,650.67 |

$0.00 |

$39,650.67 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$30,128.95 |

$0.00 |

$30,128.95 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$28,493.83 |

($661.44) |

$27,832.39 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$32,070.05 |

($5,677.02) |

$26,393.03 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$36,472.21 |

$0.00 |

$36,472.21 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$35,432.42 |

$0.00 |

$35,432.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$31,723.77 |

$0.00 |

$31,723.77 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$29,175.10 |

$0.00 |

$29,175.10 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$30,142.63 |

$0.00 |

$30,142.63 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$31,221.80 |

$0.00 |

$31,221.80 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$7,645.61 |

$0.00 |

$7,645.61 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 36061-2024 |

05/31/2024 |

05/31/2024 |

COVLAND |

COVENANT CLEARINGHOUSE LLC BY (ET AL) |

WHOM OF INTEREST |

| 164327-2021 |

09/21/2021 |

09/23/2021 |

REVDECL |

COVENANT CLEARINGHOUSE LLC |

WHOM OF INTEREST |

| 44226-2020 |

04/03/2020 |

04/06/2020 |

N |

PACIFICORP DBA (ET AL) |

WHOM OF INTEREST |

| 28824-2020 |

02/18/2020 |

03/05/2020 |

R/W EAS |

ICO MULTIFAMILY HOLDINGS LLC |

ROCKY MOUNTAIN POWER DIV OF (ET AL) |

| 35-2018 |

12/22/2017 |

01/02/2018 |

REC |

WELLS FARGO BANK NORTHWEST TEE |

RESIDENCES AT MAYFIELD LLC |

| 126852-2017 |

12/01/2017 |

12/20/2017 |

AS |

KEYBANK NATIONAL ASSOCIATION |

FANNIE MAE |

| 126851-2017 |

12/15/2017 |

12/20/2017 |

D TR |

RESIDENCES AT MAYFIELD LLC BY (ET AL) |

KEYBANK NATIONAL ASSOCIATION |

| 89505-2014 |

12/08/2014 |

12/11/2014 |

D TR |

RESIDENCES AT MAYFIELD LLC |

WELLS FARGO BANK |

| 89504-2014 |

12/10/2014 |

12/11/2014 |

SP WD |

ICO MULTIFAMILY HOLDINGS LLC (ET AL) |

RESIDENCES AT MAYFIELD LLC |

| 14962-2014 |

03/03/2014 |

03/05/2014 |

CON RAT |

RICKS, ARIEL TEE (ET AL) |

RESIDENCES AT MAYFIELD PLAT A |

| 13947-2014 |

11/06/2013 |

03/03/2014 |

S PLAT |

ICO MULTI-FAMILY HOLDINGS LLC (ET AL) |

RESIDENCES AT MAYFIELD PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/10/2025 7:46:56 AM |