Property Valuation Information

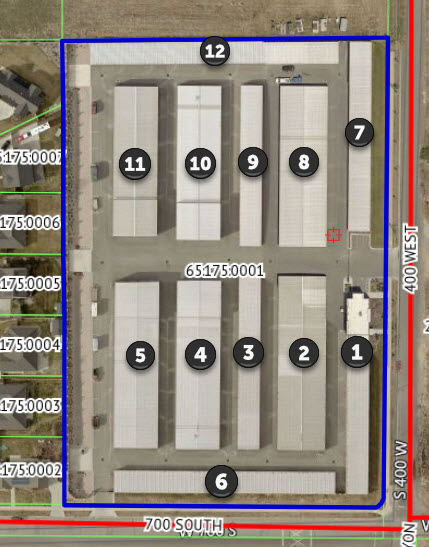

- Serial Number : 651750001

- Tax Year : 2025

- Owner Names : DEGRAW SPRINGVILLE STORAGE LLC

- Property Address : 636 S 400 WEST - SPRINGVILLE

- Tax Area : 131 - SPRINGVILLE W/SPRV DRAIN DIST

- Acreage : 6.516

- Property Classification : MRCB - MULTIPLE RES + COMM > 1 ACRE

- Legal Description : LOT 1, PLAT A, CRYSTAL SPRINGS SUBDV. AREA 6.516 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $139,400 |

$140,400 |

|||||||

| Non-Primary Residential | $8,540,700 |

$8,654,000 |

|||||||

| Total Property Market Value | $8,680,100 | $8,794,400 | |||||||