Property Valuation Information

- Serial Number : 170060044

- Tax Year : 2025

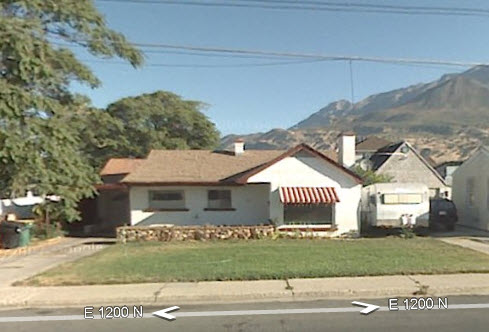

- Owner Names : CORLESS, BRADY & ASHLEE N

- Property Address : 83 E 1200 NORTH - OREM

- Tax Area : 090 - OREM CITY

- Acreage : 0.21

- Property Classification : RP - RES PRIMARY

- Legal Description : COM E ALONG SEC LINE 478.5 FT & N 28.84 FT FR SW COR SEC 2, T6S, R2E, SLM; N 142.91 FT; E 65 FT; S 142.89 FT; S 89-59'19"W 65.00 FT TO BEG. AREA .21 ACRES.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $367,700 |

$392,000 |

|||||||

| Total Property Market Value | $367,700 | $392,000 | |||||||