Property Valuation Information

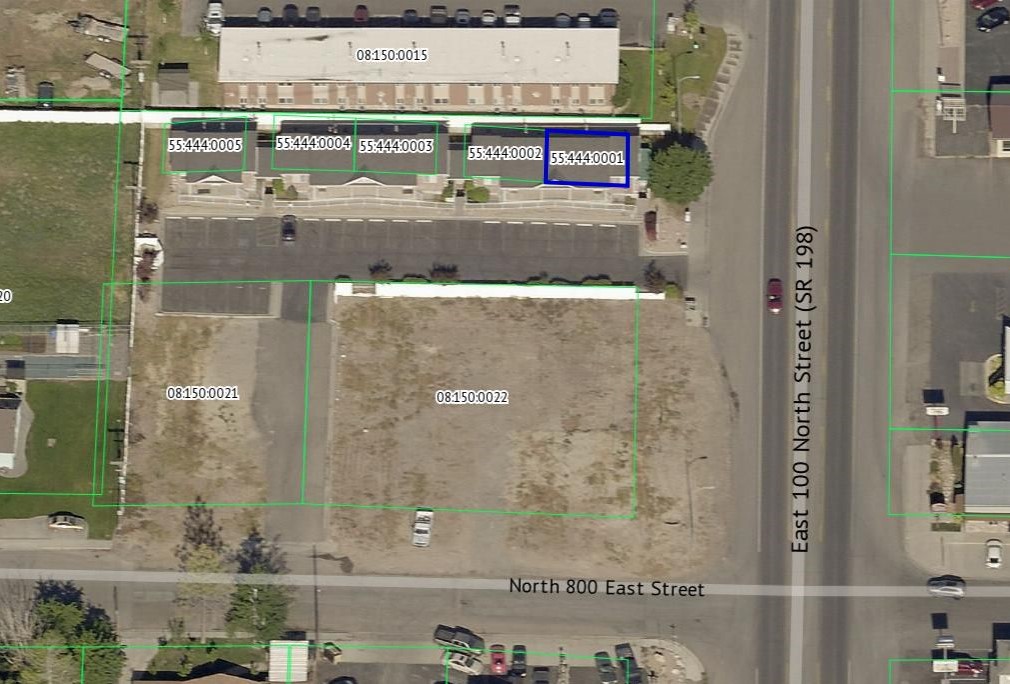

- Serial Number : 554440001

- Tax Year : 2025

- Owner Names : P I A ENTERPRISES LLC

- Property Address : 762 E 100 NORTH - PAYSON

- Tax Area : 170 - PAYSON CITY

- Acreage : 0.022

- Property Classification : COP - COMM PUD

- Legal Description : LOT 1, PLAT A, WASATCH BUSINESS CENTER SUBDV. AREA 0.022 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Non-Primary Residential | $312,500 |

$318,800 |

|||||||

| Total Property Market Value | $312,500 | $318,800 | |||||||