Property Valuation Information

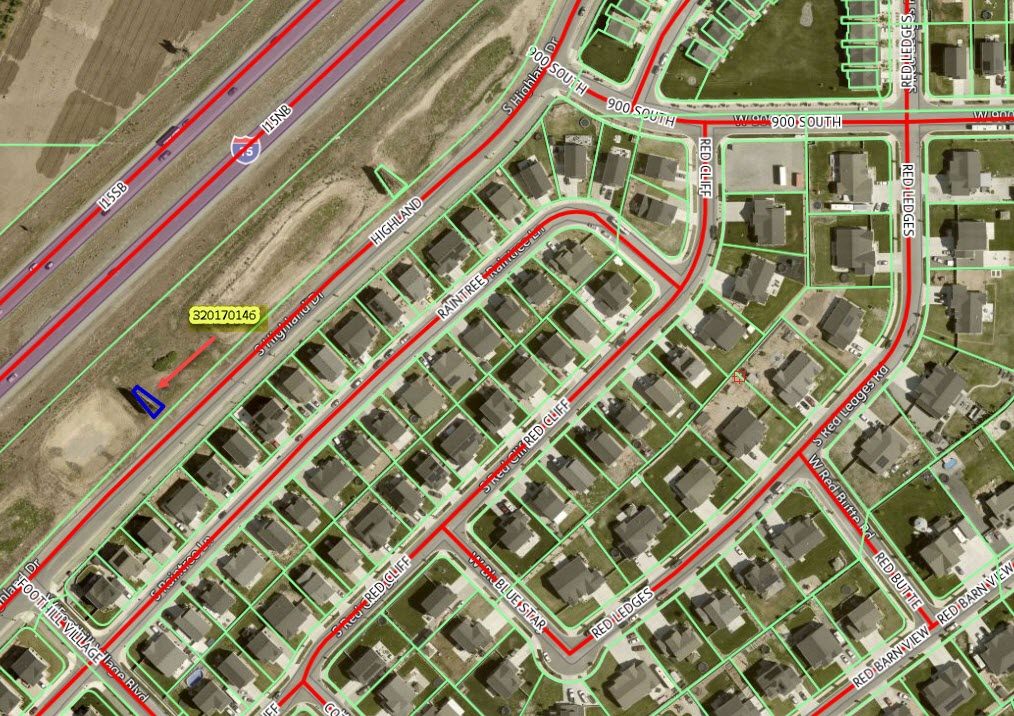

- Serial Number : 320170146

- Tax Year : 2025

- Owner Names : THOMSON APARTMENTS LLC

- Property Address :

- Tax Area : 190 - SANTAQUIN CITY

- Acreage : 0.017723

- Property Classification : V - VACANT

- Legal Description : COM W 1928.33 FT & S 427.35 FT FR E 1/4 COR. SEC. 11, T10S, R1E, SLB&M.; S 53 DEG 24' 45" E 49.96 FT; S 43 DEG 27' 7" W 21.2 FT; N 40 DEG 25' 44" W 49.97 FT; N 43 DEG 55' 28" E 9.9 FT TO BEG. AREA 0.018 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Vacant | $49,200 |

$51,000 |

|||||||

| Total Property Market Value | $49,200 | $51,000 | |||||||